Nonprofits: 4 Ratios Worth Watching

What if we told you that only four ratios mattered when it came to managing your nonprofit? OK, that would be an exaggeration. But there are four measures that generally matter more than the rest.

Education Benefits Help Attract, Retain And Motivate Your Employees

An educational assistance program can be a win-win. Employees value the perk and employers can benefit from a more educated, motivated workforce. Here are the basic tax rules.

4 Ways Corporate Business Owners Can Help Ensure Their Compensation Is “Reasonable”

C corporation owners: To keep your compensation tax deductible, you need to ensure it’s “reasonable.” Otherwise, it could be deemed a dividend. Here are four steps to take.

Take Advantage Of The Rehabilitation Tax Credit When Altering Or Adding To Business Space

The federal tax code encourages businesses to invest in historic buildings with a tax credit. Here are the rules.

Retirement Saving Options For Your Small Business: Keep It Simple

If you’re a small business owner, you may be reluctant to set up a retirement plan because of the administrative burdens. Here are two options to consider that have far fewer requirements than traditional qualified retirement plans.

The Current Standard For Approving 401(k) Hardship Distributions

Does your organization offer employees a 401(k) plan? If so, be sure you’re familiar with the current standard for approving hardship distributions.

Are Employees Taxed On Frequent Flyer Miles Earned Through Business Travel?

Employers: Do you have employees who accrue frequent flyer miles from business travel? If so, look carefully at the tax rules involved with the use of those miles.

Small Employers: Don’t Forget About The New And Improved Pension Credit

Small employers: Is now the time to launch a qualified retirement plan for employees? The SECURE 2.0 Act, signed into law last year, offers some substantial incentives to do so.

How Businesses Can Use Stress Testing To Improve Risk Management

Business owners: The recent news stories about failed or troubled banks has probably caught your eye. Consider it fair warning to engage in sound risk management practices, such as stress testing.

ACA Penalties Will Rise In 2024

Business owners: Be advised that penalties levied under the Affordable Care Act will be going up next year. Now’s a good time to determine whether your company could be at risk.

Keep An Eye Out For Executive Fraud

Many business owners believe no one on their leadership team would ever steal or cheat. Yet executive fraud costs companies hundreds of thousands of dollars annually.

Forming A Cross-Functional Sales Team

You’d be hard-pressed to find a business owner who doesn’t want to improve sales. One potential way to do so is to form a cross-functional sales team.

New-And-Improved Accounting Rules For Common Control Leases

Coming soon! The FASB recently issued amendments to help organizations that rent property from related parties report those arrangements on their balance sheets.

How To Get More From Your Company’s Income Statement

Financial reporting is more than an exercise in compliance. Proactive owners and managers view their income statements as a diagnostic tool to gauge performance and fix inefficiencies and anomalies.

Demystifying Deferred Taxes

When reviewing a company’s financial statements, you may wonder: What are deferred taxes and how does the company quantify them? Wonder no more.

Going Green Could Save Greenbacks And More

Has the start of spring piqued your interest in green business practices? Eco-friendly initiatives can be good for the earth, as well as your company’s bottom line and long-term value.

Breathe New Life Into A Trust By Decanting It

Decanting can make your wine taste better and provide your trust greater flexibility.

An Estate Planning “Road Map” Can Act As A Catchall For Your Final Thoughts

Do your loved ones a favor by creating a “road map” to your estate plan.

Should You Move Your Trust To Another State?

The variables are many when determining whether you can move your trust to another state.

How To Outsmart Social Media Scammers

Social media is popular not only with the general public and businesses, but with fraud perpetrators. Learn how to avoid being conned while spending time on social media.

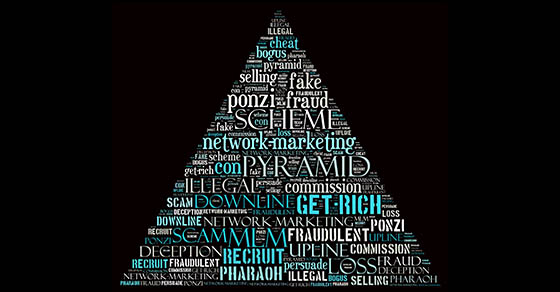

That Investment Opportunity Could Be A Pyramid Scheme

Would you know a pyramid scheme if you saw it? Many sophisticated businesspeople become trapped by fraudulent investment “opportunities.” Here’s what to look for to avoid getting scammed.