By Andrew Lampropoulous

Health insurance is a hot social issue in America today, but one thing many Americans aren’t talking about are tax-free options to pay for their medical expenses: health savings accounts (HSAs) and flexible spending arrangement (FSAs).

What is an HSA?

An HSA plan is a tax-advantage health savings account that is paired with a high-deductible health insurance plan, allowing for lower monthly insurance premiums. The biggest benefit of an HSA is the money put into the account and the interest earned by the account are tax free as long as the funds are used for qualified medical expenses. The IRS provides a list of expenses that it deems to be qualified medical expenses, including healthcare services, equipment, and prescription medications. Included in healthcare services are any deductibles paid for those services, therefore off-setting the burden of a high deductible.

HSAs and Your Taxes

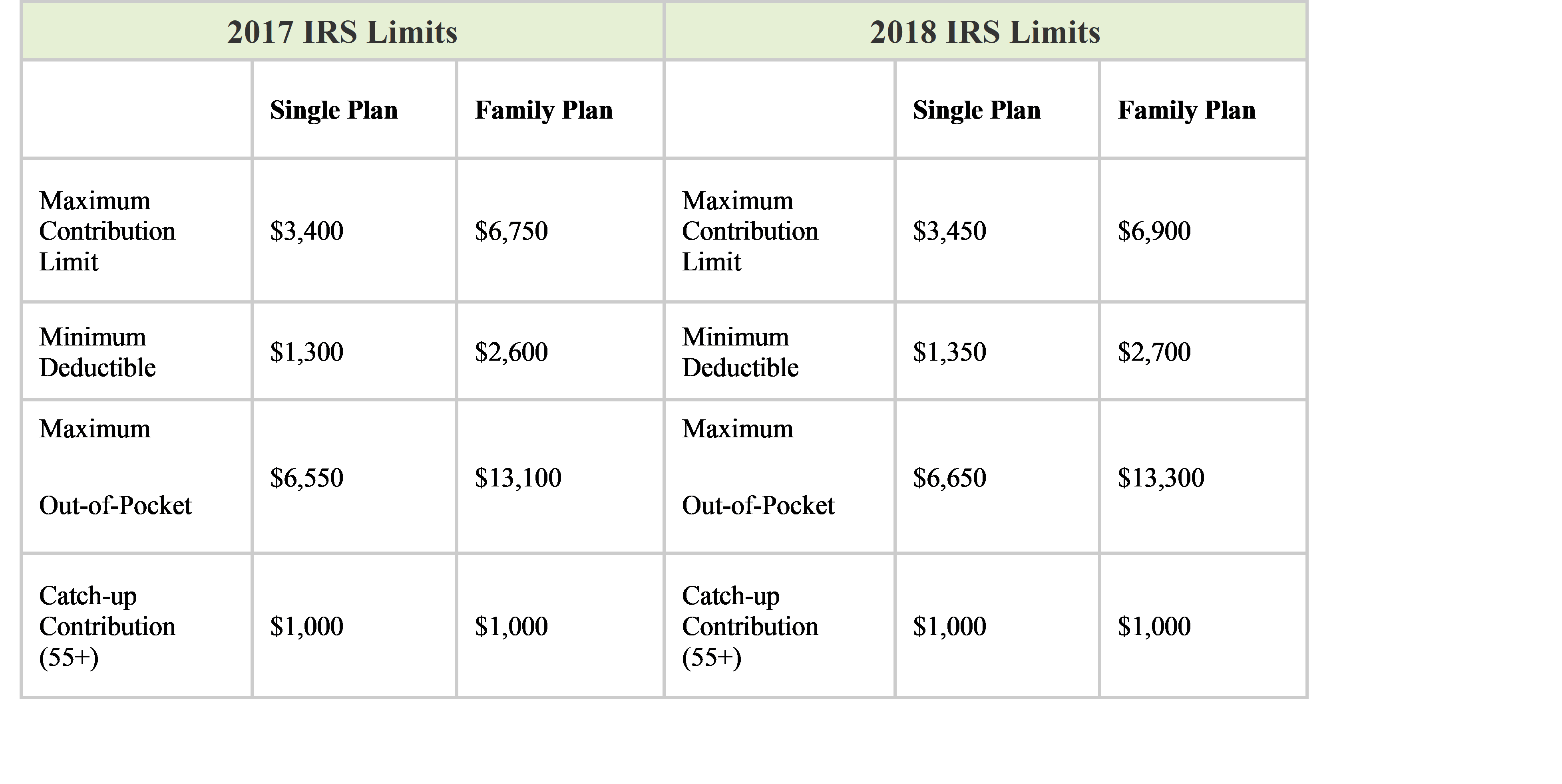

As long as HSAs are used for qualified medical expenses they are tax free. The funds must be used by the taxpayer, the taxpayer’s spouse, or a dependent of the taxpayer. In the latter case, one must use the IRS’ definition of a dependent, so even though children can stay on their parents’ health plan until they are 26, once they are no longer a dependent for tax purposes they are not eligible for HSA funds. The table below shows the 2017 and 2018 IRS limits.

*table from http://www.hsabank.com/hsabank/education/irs-guidelines-and-eligible-expenses

In most cases, if individuals under the age of 65 use HSA funds to pay for nonqualified medical expenses they face a penalty of 20 percent of the funds used. On top of the 20 percent penalty, individuals are then taxed on the funds used for the nonqualified medical expenses.

What is a FSA?

FSA health care accounts allow for taxpayers or their employer to set aside funds, commonly through a reduction in their salary, to use for qualified medical expenses. Taxpayers may contribute no more than $2,600 for 2017. As with HSAs, these funds must be used for qualified medical expenses. A major difference between FSAs and HSAs is that FSAs do not have to be paired with high-deductible health plans. Another difference is that FSAs are commonly known as “use it or lose it plans” because any funds not used at the end of the year cannot be carried over to the following year. However, some plans may allow for a two-and-a-half-month grace period after the end of the year to use any excess funds, and others may permit a carryover of $500 of unused funds to be used in the following year. FSAs are set up through a taxpayer’s employer, and the employer must comply with government regulations.

FSAs and Your Taxes

The funds taken out of the taxpayer’s salary are pre-tax and FSAs are not required to be reported on a taxpayer’s form 1040.

---

The information contained in the Knowledge Center is intended solely to provide general guidance on matters of interest for the personal use of the reader, who accepts full responsibility for its use. In no event will CST or its partners, employees or agents, be liable to you or anyone else for any decision made or action taken in reliance on the information in this Knowledge Center or for any consequential, special or similar damages, even if advised of the possibility of such damages.