Business Provisions

Clarification of Tax Treatment of PPP-Related Expense Deductions and Loan Forgiveness

In May 2020, the IRS issued guidance that disallowed the deduction of otherwise allowable expenses in the amount of any tax-free forgiven PPP loans, because those expenses were allocated to tax-exempt income.

However, the CAA 2021 now provides that taxpayers with forgiven PPP loans are allowed deductions for otherwise deductible expenses paid with the proceeds of a PPP loan. Furthermore, the borrower’s tax basis and other attributes will not be reduced as a result of the loan forgiveness.

Clarification of Tax Treatment of EIDL Grants, Certain Loan Forgiveness, and Other Business Financial Assistance under the CARES Act

The CARES Act expanded access to Economic Injury Disaster Loans (EIDL) and established an emergency grant allowing an EIDL applicant to request a $10,000 advance on that loan. The CARES Act also provided loan repayment assistance for certain recipients of CARES Act loans.

The CAA 2021 clarifies that gross income does not include forgiveness of EIDL loans, emergency EIDL grants, or certain loan repayment assistance. The Act also clarifies that deductions are allowed for otherwise deductible expenses paid with the proceeds of these loans, and that tax basis and related attributes will not be reduced as a result of those amounts being excluded from gross income.

Depreciation of Certain Residential Rental Property over 30-year Period

The Tax Cuts and Jobs Act (TCJA) allowed real property trade or businesses to elect out of the business interest deduction limitations imposed by the TCJA. In return, however, the electing taxpayer had to depreciate nonresidential real property, qualified improvement property, and residential rental property over a longer time period for tax years beginning after December 31, 2017.

For tax years beginning after December 31, 2017, the CAA 2021 assigns a 30-year ADS depreciation period instead of a 40-year period to residential rental property, even if it was placed in service before January 1, 2018.

50% Limit on Business Meal Deduction Is Suspended for Meals Provided by Restaurants in 2021 and 2022

Taxpayers may generally deduct the ordinary and necessary food and beverage expenses associated with operating a trade or business, including meals consumed by employees on work travel. The deduction is generally limited to 50% of the otherwise allowable amount.

Under the CAA 2021, the 50% limit won’t apply to expenses for food or beverages provided by a restaurant that are paid or incurred after December 31, 2020, and before January 1, 2023. The use of the word “by” rather than “in” a restaurant makes it clear that the new rule isn’t limited to meals eaten on the restaurant’s premises. Takeout and delivery meals provided by a restaurant are also fully deductible.

Minimum Age for Distributions during Working Retirement

The Internal Revenue Code provided that a trust forming part of a pension plan shall not be treated as failing to constitute a qualified trust (i.e., will not be subject to tax) solely because the plan provides that a distribution may be made from such trust to an employee who has attained age 59½ and who is not separated from employment at the time of such distribution.

The CAA 2021 states that these pension plan trusts won’t lose their status as qualified trusts solely because the plan allows certain employees in the building and construction industries who are not separated from employment to take distributions at age 55. The amendment applies to distributions made before, on, or after December 27, 2020.

Temporary Special Rules for Health and Dependent Care Flexible Spending Arrangements (FSAs)

A cafeteria plan may sometimes permit the carryover of unused amounts remaining in a health FSA at the end of the plan year. These amounts can be used to pay or reimburse a participant for medical care expenses incurred during the following plan year, subject to the carryover limit (currently $550). This is sometimes referred to as the carryover rule.

The CAA 2021 expands the carryover period for 2020 and 2021. Employers can now extend the grace period for plan years ending in 2020 and 2021 to 12 months after the end of such plan year for unused benefits and contributions to health FSAs and dependent care FSAs.

In addition, an employer may allow an employee who ceases to participate in the plan during calendar year 2020 or 2021 to continue to receive reimbursements from unused benefits or contributions through the end of their final plan year, including any extended grace period.

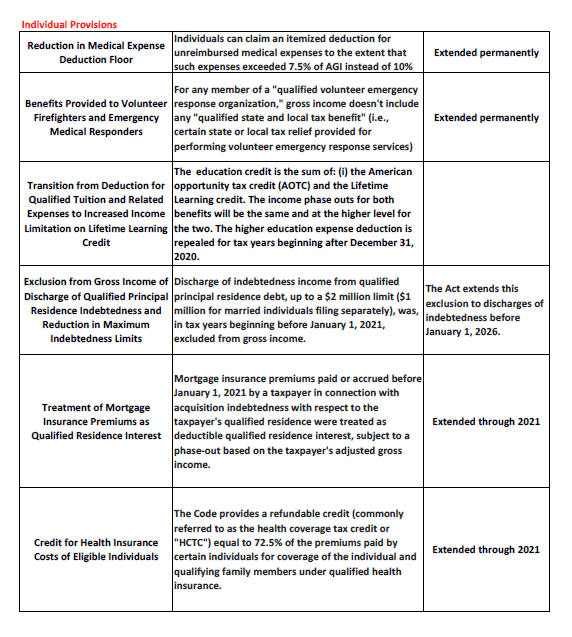

Individual Provisions

New Recovery Rebate

The CAA 2021 provides a refundable tax credit to eligible individuals in the amount of $600 per eligible family member. The credit is $600 per taxpayer ($1,200 for married filing jointly), in addition to $600 per qualifying child. The credit phases out starting at $75,000 of modified adjusted gross income ($112,500 for heads of household and $150,000 for married filing jointly) at a rate of $5 per $100 of additional income. The checks being mailed to taxpayers are treated as advance payments on this credit.

The term “eligible individual” does not include any nonresident alien, anyone who qualifies as another person’s dependent, any estate, or any trust. The credit is available on the taxpayer’s 2020 return. Taxpayers receiving an advance payment that exceeds the amount of their eligible credit will not be required to repay any amount of the payment. If the amount of the credit determined on the taxpayer’s 2020 tax return exceeds the amount of the advance payment, taxpayers will receive the difference as a refundable tax credit. Advance payments are generally not subject to administrative offset for past due federal or state debts. In addition, the payments are protected from bank garnishment or levy by private creditors or debt collectors.

$250 Educator Expense Deduction Applies to PPE

Eligible educators (i.e., kindergarten through grade-12 teachers, instructors, etc.) are allowed a $250 above-the-line deduction for certain eligible supplies they purchase.

The CAA 2021 requires the IRS to clarify that personal protective equipment (PPE), disinfectant, and other supplies used for the prevention of the spread of COVID-19 are treated as eligible supplies. This provision will apply to expenses paid or incurred after March 12, 2020.

Individuals May Base 2020 Refundable CTC & EIC on Preceding Year’s Earned Income

To the extent the child tax credit (CTC) exceeds the taxpayer’s tax liability, the taxpayer is eligible for a refundable credit equal to 15% percent of the taxpayer’s taxable earned income over $2,500. The earned income credit (EIC) equals a percentage of the taxpayer’s earned income. For both purposes, earned income means wages, salaries, tips, and other employee compensation, if includible in gross income for the tax year. Earned income also includes self-employment income, computed without the deduction for one-half of self-employment tax.

Under the CAA 2021, in determining the refundable CTC and the EIC for 2020, taxpayers may elect to substitute their earned income for the preceding tax year in the credit calculations if that amount is greater than the taxpayer’s earned income for 2020.

Certain Charitable Contributions Deductible by Non-Itemizers

For 2020, individuals who normally do not itemize deductions may take up to a $300 above-the-line deduction for cash contributions to qualified charitable organizations. This $300 limit also applies to married filers.

The CAA 2021 extends the above deduction rule through 2021, allowing individuals an above-the-line deduction of for up to $300 ($600 for married filers in 2021) of cash contributions to qualified charitable organizations.

Modification of Limitations on Charitable Contributions

Under prior law, individuals could not take an itemized deduction of more than 60% of their contribution base on charitable contributions of cash. The CARES Act provided that taxpayers could elect to substitute 100% for 60% with respect to contributions made in 2020. This has been extended through 2021.

---

The information contained in the Knowledge Center is intended solely to provide general guidance on matters of interest for the personal use of the reader, who accepts full responsibility for its use. In no event will CST or its partners, employees or agents, be liable to you or anyone else for any decision made or action taken in reliance on the information in this Knowledge Center or for any consequential, special or similar damages, even if advised of the possibility of such damages.