Today’s blog is authored by CST Group Partner Brian Morrison. It originally appeared in Access National Bank’s Access Business Advisor Newsletter, Spring 2014 Edition.

Now that taxes are filed, it’s time for Employee Benefit Plan Audit Season. Each year, the rules and regulations governing Employee Benefit Plan compliance grow increasingly more complex. With heightened scrutiny from the Department of Labor, it’s important that your organization’s Employee Benefit Plan audit is compliant with all applicable requirements.

First, organizations must determine which of their plans may require an audit. These plans could be:

- Defined contribution plans

- Defined benefit plans

- Health and welfare plans

- Employee Stock Ownership Plans (ESOP)

- 403(b) Plans

- 401(k) Plans

If the number of eligible participants in your plan has changed since your last filing, you may be in need of an audit. Eligible participants include:

- Active – currently employed by plan sponsor (could be participating or not participating)

- Retired or separated – no longer employed by the plan sponsor, but still has assets in the plan.

- Deceased – have passed away, but their beneficiaries have assets in the plan or are receiving/entitled to receive benefits.

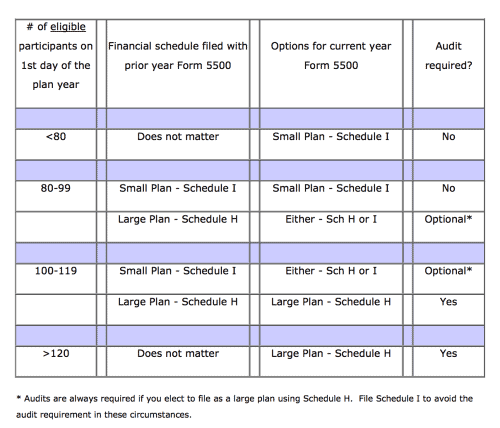

The table below illustrates most possible situations:

Of course, there are always exceptions to the audit requirements. For example, if the Plan would qualify as a large Plan and its Plan year is seven months or less, the Plan sponsor may elect to defer the audit requirement to the following Plan year (this is referred to as a “Short Plan Year”). Another exception is the “80-120 Participant Rule,” which allows a plan that filed Form 5500 as a “small plan” last year to file its current Form 5500 in the “small plan” category again this year. It also allows a plan to forego the audit requirement if it now has up to 120 participants at the beginning of the current plan year, which otherwise would meet the 100 participant threshold and require a “large plan” filing and annual audit.

If your organization is in need of an audit, one of two types may be required: either a DOL Limited-Scope Audit or a Full Scope Audit. If your plan trustee or custodian can provide certified trust statements regarding the value of the investments (for more information on which parties and documents meet those requirements, visit the AICPA), then a DOL Limited-Scope Audit will suffice. While this type of audit won’t go quite as far as the Full Scope Audit, the auditor must still assess and document internal controls and risks of non-investment activity, including participant eligibility, employee and employer contributions, benefit payments, and plan administrative expenses.

If you discover that your Plan will need an audit, don’t panic. An experienced CPA can guide you through the process. When selecting a CPA for Employee Benefit plan audit services, it’s essential to look for a firm that can offer the following:

- A dedicated team of CPAs specializing in Employee Benefit Plan audits

- A strong technical knowledge of GAAP, GAAS, ERISA and DOL requirements;

- Significant and up-to-date knowledge of regulatory requirements;

- An ability to effectively communicate with your third party plan administrator

For more information about Employee Benefit Plan Audits, contact Brian Morrison.

---

The information contained in the Knowledge Center is intended solely to provide general guidance on matters of interest for the personal use of the reader, who accepts full responsibility for its use. In no event will CST or its partners, employees or agents, be liable to you or anyone else for any decision made or action taken in reliance on the information in this Knowledge Center or for any consequential, special or similar damages, even if advised of the possibility of such damages.