Congratulations to Brooke Mock on her 10-yr work Anniversary!

Please join us in congratulating Brooke Mock on her 10-year anniversary with CST Group! Congratulations to Brooke as she reaches this special milestone, reflecting her exceptional [...]

Congratulations to Doug Steger on his 10-yr Anniversary!

Please join us in congratulating Doug Steger on his 10-year anniversary with CST Group! The end of this year marks a special milestone as Doug reaches his tenth-year anniversary wi [...]

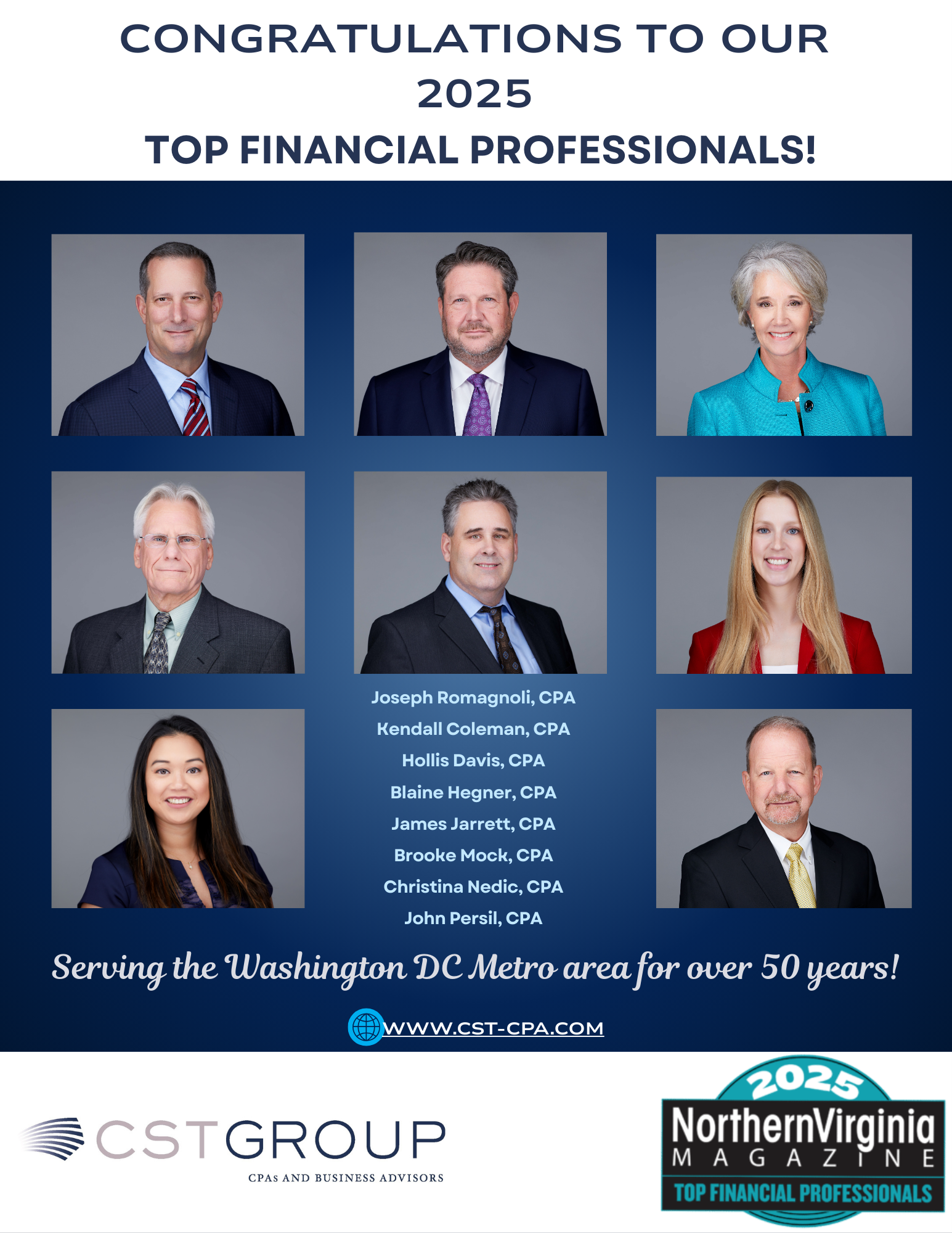

Congratulations to CST’s 2025 Northern Virginia Magazine’s Top Financial Professionals

Congratulations to CST's 2025 Northern Virginia Magazine's Top Financial Professionals

CST Group Named One of IPAs Top 300 Accounting Firms for 2025

CST Group, a leading CPA and business advisory firm based in Reston, VA, has once again been recognized among INSIDE Public Accounting’s (IPA) Top 300 Firms for 2025. This marks th [...]

Congratulations to Matthew Wasserman on his 10-yr anniversary!

Please join us in congratulating Matthew Wasserman on his 10-year anniversary with CST Group! This exceptional milestone is a testament of Matthew’s tireless work ethic, and steadf [...]

Congratulations to Christina Nedic on her 10-yr work anniversary!

Please join us in congratulating Christina Nedic on her 10-year anniversary with CST Group! While this special milestone was officially reached last December, there’s no expiration [...]

CST Group Runs With The Arc of Northern Virginia Team Challenge 5k

CST Group participated in The Arc of Northern Virginia Team Challenge 5k on Saturday, June 7, 2025. Chris Roth, Jill Travers-Carver, Christina Nedic, and Quinn Cambas' parti [...]

2024 CST Group Ugly Sweater Contest!

CST Group got festive and held their annual Ugly Sweater Contest! Congratulations Amy for First Place! Trey in Second and Taylor in Third! Thank you to all the participants and Hap [...]

2024 CST Group Business Appreciation

Thank you so much to those who attended this years CST Group Business Appreciation! [...]

CST Group Earns Spot on INSIDE Public Accounting’s 2024 Top 300 Firms List

INSIDE Public Accounting (IPA) is North America’s leader in CPA Practice Management and provides firm leaders with data-driven insights and thought leadership to enhance their practices.

Christina Nedic Elected to Greater Reston Chamber of Commerce Board of Directors

"I am deeply honored to be selected as a member of the GRCC Board of Directors. I look forward to continuing my engagement with this remarkable community and working alongside its exceptional leaders," said Christina.

Greater Reston Chamber of Commerce June Network Night

This is a classic summertime tradition for the Chamber as we will enjoy a great evening of networking on CST Group's corporate rooftop!!

Elected President of Northern Chapter of VSCPA

Mohammad Sadeghi, Director at CST since December 2023, has recently been elected as the President of the Northern Chapter of the Virginia Society of Certified Public Accountants (VSCPA).

CST Group Announces New Partners

Reston, VA January 1, 2024 It is with great pleasure that we introduce our newest partners, Melissa Flieg, Daniel Keaton and Kara Shelton. Melissa has been with CST Group for just [...]

CST Group Ugly Sweater Contest!

CST Group held their annual Ugly Sweater Contest, find out who the winners are!

CST Group Open House

CST Group's Open House to celebrate our 50th Anniversary!

Happy National Taco Day!

CST Group celebrates National Taco Day today!

Women Giving Back!

CST Group joins Women Giving Back to help support their community!

CST Group Named To The INSIDE Public Accounting 2023 Top 300 Firms

CST Group, CPAs and business advisors in Reston, VA has been named to the INSIDE Public Accounting’s 2023 Top 300 Firms list.

CST Group Named to the INSIDE Public Accounting 2022 Top 300 Firms

CST Group, an accounting firm based in Reston, VA was recently named to the INSIDE Public Accounting 2022 Top 300 Firms list. This is the sixth consecutive year that CST Group has been given this honor, demonstrating an impressive commitment to excellence and sustainability.

Christina Duong named Co-Chair of the GRCC Emerging Professionals Council

Christina Duong, Manager, named Co-Chair of the GRCC Emerging Professionals Council